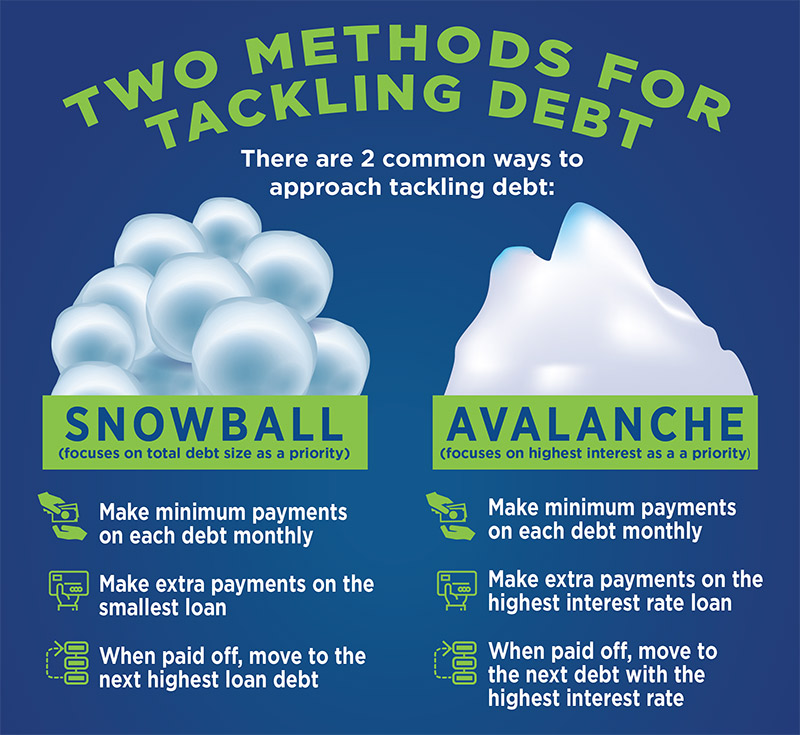

Are you drowning in a sea of debt and searching for the best way to regain control of your financial future? You’re not alone – many individuals face this challenge. The two popular debt payoff methods —Debt Snowball and Debt Avalanche — have emerged as effective solutions. In this article, we’ll explore the key differences between debt snowball vs. debt avalanche and help you decide which one might be the right fit for your unique financial situation.

Understanding the Basics

Before we dive into the specifics, let’s clarify what Debt Snowball and Debt Avalanche entail:

Debt Snowball:

The Debt Snowball method, popularized by personal finance guru Dave Ramsey, focuses on psychology and motivation. Here’s essentially how it works:

- List Your Debts: Start by listing all your debts, from the smallest balance to the largest.

- Minimum Payments: Continue making the minimum payments on all your debts.

- Extra Payments: Allocate any extra funds you have to the debt with the smallest balance.

- Snowball Effect: As each debt is paid off, roll the amount you were paying on that debt into the next smallest balance.

Debt Avalanche:

The Debt Avalanche method takes a more mathematically strategic approach to debt payoff:

- List Your Debts: Similar to the Debt Snowball, list all your debts, but this time order them from the highest interest rate to the lowest.

- Minimum Payments: As with the Snowball method, make the minimum payments on all your debts.

- Extra Payments: Allocate any extra funds to the debt with the highest interest rate.

- Avalanche Effect: Once the highest-interest debt is paid off, move on to the one with the next highest interest rate.

Key Differences

Now, let’s compare these two strategies:

- Psychology vs. Math: The primary difference between the two methods lies in their approach. Debt Snowball harnesses the power of small wins and quick victories to keep you motivated, whereas Debt Avalanche relies on math and interest rate savings.

- Interest Costs: Debt Avalanche typically saves you more money in the long run because you’re targeting high-interest debts first. However, Debt Snowball can provide a psychological boost as you see debts being paid off sooner.

- Timeline: Debt Snowball may lead to quicker wins early in the process, while Debt Avalanche may take longer to see significant progress, especially if the highest-interest debt is also the largest.

Choosing the Right Strategy

So, which strategy should you choose? The answer depends on your personal financial situation and psychology:

- Debt Snowball: Opt for this method if you need quick wins to stay motivated, even if it means paying a bit more in interest over time.

- Debt Avalanche: Choose this method if you’re more financially disciplined and prioritize interest savings, even if it takes longer to see significant progress.

Remember, the key to success with either strategy is consistency. Stick to your chosen method, maintain a budget, and avoid accumulating new debt. So whichever path you take, the important thing is that you’re actively working toward a debt-free future.

About Us

Our mission is to provide a trusted and comprehensive resource hub where individuals can find inspiration, guidance, and practical tools to better themselves. Through our carefully curated content, we aim to address various aspects of personal development, including self-confidence, motivation, mindset, relationships, productivity, and overall well-being. Awaken the Champ is reader-supported. When you buy through links on our site, we may earn an affiliate commission.